“MSME stands for Micro, Small, and Medium Enterprises and is the backbone of the economy. MSME is the apex executive body for the implementation and administration of rules, regulations, and laws relating to Micro, Small, and Medium Enterprises. Both the Manufacturing and Service sectors can apply for Registration.”

MSME Registration

MSME stands for Micro, Small, and Medium Enterprises and is the backbone of the economy. MSME is the apex executive body for the implementation and administration of rules, regulations, and laws relating to Micro, Small, and Medium Enterprises. Both the Manufacturing and Service sectors can apply for Registration.

The Below-mentioned entities are eligible for registration-

All the micro, small and medium level business entities falling in the prescribed parameter, can apply for MSME in India. Apart from Micro, small, and medium level enterprises-

Who all are Eligible for MSME?

The Below-mentioned entities are eligible for registration-

All the micro, small and medium level business entities falling in the prescribed parameter, can apply for MSME in India. Apart from Micro, small, and medium level enterprises-

- Limited liability partnerships (LLP),

- A private limited company (Pvt. Ltd.),

- One-person companies (OPC),

- Proprietorship firms and

- Public companies can apply for registration. Also, if the Company is in the manufacturing or the service sector can go for MSME Registration.

- Any entity having a valid Aadhar Number as apply for MSME. As a result, the Aadhaar Number is mandatory for the issuance of an MSME Certificate.

| Classification | Micro | Small | Medium |

|---|---|---|---|

| Manufacturing & Service | 1. Investment Less Than Rs. 1 Cr. 2. Turnover Less Than Rs. 5 Cr. | 1. Investment Less Than Rs. 10 Cr. 2. Turnover Less Than Rs. 50 Cr. | 1. Investment Less than Rs. 50 Cr. 2. Turnover Less Than Rs. 250 Cr. |

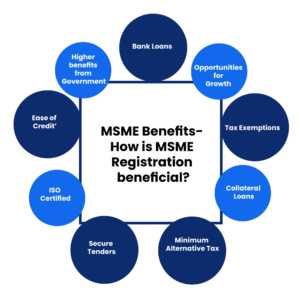

What are the Benefits of Availing the MSME Registration?

MSME Registration provides various benefits to Micro, Small, and Medium Enterprises. A Few of them are mentioned below: –

- Helps In Obtaining the Government Tenders: MSME assists to acquire government tenders with no trouble as Udyam Registration Portal is incorporated with Government e-Marketplace & various other State Government portals which present easy access to their marketplace & e-tenders.

- Exemptions Under Direct Tax Laws: Enterprises that enclose MSME Registration can benefit from Direct Tax Exemption in the early year of business, as stated in the scheme by the Government & depending on business activity too.

- Collateral Free Loans from Banks: The Government of India has authorized collateral-free credit available to all small & micro business sectors. This scheme guarantees funds to micro and small division enterprises. Under this very scheme, both the old and new enterprises can seek the benefits. The ‘Credit Guarantee Fund Scheme’ (CGS) for Micro & Small Enterprises was launched by the Government of India to make accessible collateral-free credit to the micro & small enterprise sector. Both the existing & the new enterprises are entitled to be covered under this scheme.

- Exemption On the Overdraft Interest Rate: Enterprises or Businesses registered under MSME can gain a benefit of 1% on the Over Draft as stated in a scheme that varies from bank to bank.

- Claim The Expenses for The ISO Certification: The registered MSME seeks the reimbursement of the operating cost that was spent for recognition of ISO certification.

- Concession In Electricity Bills: This concession is accessible to all the Enterprises that have the MSME Registration Certificate by providing an application to the department of the electricity along with the certificate of registration by MSME.

- Subsidy On Patent Registration: A hefty 50% subsidy is given to the Enterprise that has the certificate of registration granted by MSME. This subsidy can be availed for patent registration by giving applications to the respective ministry.

- Industrial Promotion Subsidy Eligibility: Businesses registered under MSME are also qualified for getting a subsidy for Industrial Promotion as recommended by the Government.

- Protection Against Delayed Payments: Sometimes, the buyers of services and products from the MSME’s/SSIs tend to delay the payments. The Ministry of MSME lends a helping hand to such Businesses by giving them the power to collect interest on the payments that are deferred or delayed from the buyer’s side. The completion of such disputes to be done in minimum time through reconciliation and adjudication.

- Special Consideration On International Trade Fairs: Financial assistance is provided on reimbursement under the International Cooperation Scheme basis to the industries/enterprises Associations and registered societies/trusts, State/Central Government organizations, and organizations connected with MSME for delegation of MSME business to other countries. It is for discovering new areas of MSMEs, contribution by Indian MSMEs in trade fairs, international exhibitions, buyer-seller meet & for holding international conference & seminars which are in the concern of MSME sectors.

- Waiver Of Stamp Duty And Registration Fees: All new industrial units containing MSME Registration & expansions will be exempted from payments of Stamp Duty & Registration fees in India.

- Subsidy On NSIC Performance And Credit Ratings: Enterprises that encompass MSME Registration can gain Subsidy on NSIC Performance & Credit ratings as stated in the scheme.

- Eligible For Industrial Promotion Subsidy: All Enterprises that are registered under MSME Registration qualified for Industrial Promotion Subsidy (IPS) in the scheme.

What are the Essential Components of Application for Registration?

The essential components of MSME Application for MSME Registration are: –

- Name of Individual/Entity as per Aadhar card.

- Social category (General, OBC, SC/ST)

- Gender

- Physically Handicapped

- Name and type of the Organization.

- PAN Card of Individual and Enterprise

- Location/Address of Plant.

- Country, State, District, City, Tehsil, PIN Code

- Address Proof of office.

- Mobile Number and Email ID of the Applicant.

- Date of Commencement of Business

- Bank account number and IFSC code

- Business activity of the enterprise

- NIC 2 Digit Code – Based on primary activity.

- Additional information of enterprise if any

- Number of employees

- Investment amount in Plant & Machinery

What Documents Required for MSME Registration?

Apart from the above-mentioned details, requisite documents also required for MSME Registration-

- Id and Address Proof of the Applicant.

- Photograph of the Applicant.

- Aadhar Card of the Applicant.

- Documents related to the Business entity.

- Address Proof of Working premise. In the case of a Self-owned property-Sale deed required. In the case of rented property-Rent Agreement and NOC from the owner required.

- Bank-related documents.

- In the case of Partnership, Firm-Partnership Deed required.

- In the case of Company-PAN Card, MOA, AOA, and Certificate of Incorporation

Clients Testimonials

Trustindex verifies that the original source of the review is Google. I am very happyTrustindex verifies that the original source of the review is Google. Very good experience with Finaccy business solutions LLPTrustindex verifies that the original source of the review is Google. I had a good experienceTrustindex verifies that the original source of the review is Google. Very good work experienceTrustindex verifies that the original source of the review is Google. This firm has been an exceptional partner in managing our business finances. Their team is knowledgeable, professional, and always up to date with the latest tax regulations. What I appreciate most is their personalized approach. Their attention to detail, responsiveness, and transparency in pricing have been invaluable. We now feel confident in our financial future, thanks to their expert guidance. Highly recommended for any accounting needs!Trustindex verifies that the original source of the review is Google. Excellent experience with him. Right solution on right time.